Choose the State where your establishment is registered.

Enter the code no of your establishment. Note do not add Zeros '0' i.e if your code No.is 1234 it should be entered as 1234 not 0001234 the same applies to extension only if you do have extension with code no enter the character of extension do not add zeros '0', this applies to first time registration only.

Click on Get Detail and details of the Establishment should be displayed below. Verify the details.

Feed the details of the authorised person including Mobile No. (The number should be active and accessible to you to continue with registration.)

Click on GET PIN and you should receive a pin number on the mobile no you have entered.

Feed the pin and click on Register.

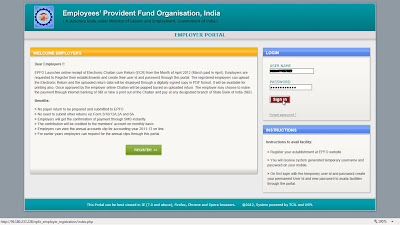

On the login page enter the temporary registration details to sign in.

Use the page to create your permanent Log-in detail.

After the login has been created you should receive a sms confirming the same.

Finally login with your permanent login to access the employers page.

Here are the available menus.